The performance of the top 10 money market funds in Kenya has maintained a positive trend despite marking a decline in their average daily effective rates in October 2024.

The overall return rate dropped to 14.21% per annum, down from 14.48% in September, a decrease closely tied to the falling Treasury Bill (T-bill) rates, which are a key component of money market funds in Kenya.

Lofty Corban and Cytonn Money Market Funds shared the top position in the Top 10 Money Market funds in Kenya for October 2024 with returns of 16.64% per annum, translating to a net return of 14.15% after taxes.

Advantages of money market funds arise from investments in short-term securities, including treasury bills, certificates of deposits and commercial papers.

The primary objective of money market funds is to provide investors with the necessary liquidity for their funds while earning a higher rate of return than that of money market funds, savings accounts or fixed deposit accounts.

List of Top 10 Money Market Funds in Kenya

| Lofty Corban Money Market Fund ~ 16.64% | GenAfrica Money Market Fund ~ 14.98% |

| Cytonn Money Market Fund ~ 16.64% | Apollo Money Market Fund ~ 14.86% |

| Etica Money Market Fund ~ 15.95% | Nabo Africa Money Market Fund ~ 14.67% |

| Arvocap Money Market Fund ~ 15.78% | Jubilee Money Market Fund ~ 14.60% |

| Kuza Money Market Fund ~ 15.73% | KCB Money Market Fund ~ 14.41% |

Lofty Corban Money Market Fund

The Lofty Corban Money Market Fund shared the top position for the best perfoming MMF in Kenya with a return of 16.64% as of October 2024.

It features a minimum initial investment of KES 1,000, USD 100 or KES 1,000,000 for its Special MMF category with top-ups starting at KES 100, USD 10, or KES 500,000 for the Special MMF.

The Fund provides low-risk, interest-earning investment opportunities through purchasing high-quality, short-term debt securities and cash and cash equivalents.

Investors are allowed to request their investments to be withdrawn within 3 days and account statements prepared in less than 24 working hours.

Interest is compounded daily and posted to the account monthly, ensuring constant growth and availability of funds for short and long-term objectives.

Cytonn Money Market Fund

The Cytonn Money Market Fund (CMMF), an investment product provided by Cytonn Asset Managers Limited, shared the top position with returns of 16.64% for October 2024.

The fund has no entry or exit fees and provides compounded daily interest, guaranteeing competitive returns and capital protection.

The USD deposits involve having an initial and top-up investment of USD 1,000 or more, though there are no management fees.

The Kenyan currency has a minimum investment of KES 100,000 with top-ups of KES 10,000, with a three-month lock-in period after which the money can be withdrawn freely.

Etica Money Market Fund

The Etica Money Market Fund offered by Etica Capital Ltd came in third among the top 10 money market funds in Kenya in the month of October 2024 with a return of 15.95%.

Its objective is to deliver a favourable current yield relative to high-quality, short-term fixed-income assets and minimize the loss of principal capital.

Some attributes of the money market fund include no lock-in period, a minimum investment of KES 100, daily compounding of profits, no initial fees and a management fee of 2.0 % p.a

Co-operative Bank Kenya Ltd manages the funds’ trusteeship while the custodianship is done by Equity Bank Kenya Ltd, thus increasing security and the level of accountancy.

Arvocap Money Market Fund

Arvocap Money Market Fund, managed by Arvocap Asset Managers, came in fourth among the top 10 money market funds in Kenya, offering a return of 15.78% in October 2024

The fund is committed to creating a favourable monetary environment for investors through investing in Kenyan government securities and corporate fixed-income products besides actively trading bonds in an attempt to outdo average bond yield returns.

The fund’s risk profile is relatively safer, having a category-one risk rating; hence, very little capital is exposed while giving reasonable returns.

It is affordable because one is only required to deposit as low as KES 3,000 as the initial capital with subsequent top-ups of at least KES 1,000.

There is no lock-in period, smooth cash flow, switches, and flexibility, ensuring that the fund is perfect for accruing your savings and meeting your financial goals systematically.

Kuza Money Market Fund

Kuza Money Market Fund (KES) posted an impressive yield of 15.73% securing the fifth position as the best performing Fund in October 2024.

The fund focuses on short-term investments, including bank deposits, treasury bills and bonds, corporate bonds, commercial papers, and collective investment schemes.

Kuza Money Market Fund includes high liquidity, a low minimum investment of Ksh.1000 and a similar amount for any subsequent top-ups, with an annual management fee of 2%.

GenAfrica Money Market Fund

GenAfrica Money Market Fund was the sixth best-performing money market fund with a return of 14.98% in October 2024.

The fund invests 83.10% in bank deposits, and the rest, 16.90%, is invested in Treasury Bonds following the right investing proportions.

A deposit of KES 500,000 is required, with no entry fees, a 2% management charge and no restrictions on withdrawal.

Yields are computed on a daily basis and generally announced in publications and on the company’s website.

Apollo Money Market Fund

Apollo Money Market Fund came in the seventh position of the top 10 money market funds in Kenya recording returns of 14.86% in the month of October 2024.

It invests in fixed deposits, Treasury bills, commercial papers, and government and corporate bonds and hence offers an attractive option to conventional fixed bank deposits.

A minimum first-time investment into the fund must be KES 1,000, with additional contributions of KES 1,000 onwards.

Customers can conveniently make regular voluntary top-ups through cheques, direct cash deposit, direct debit or standing order.

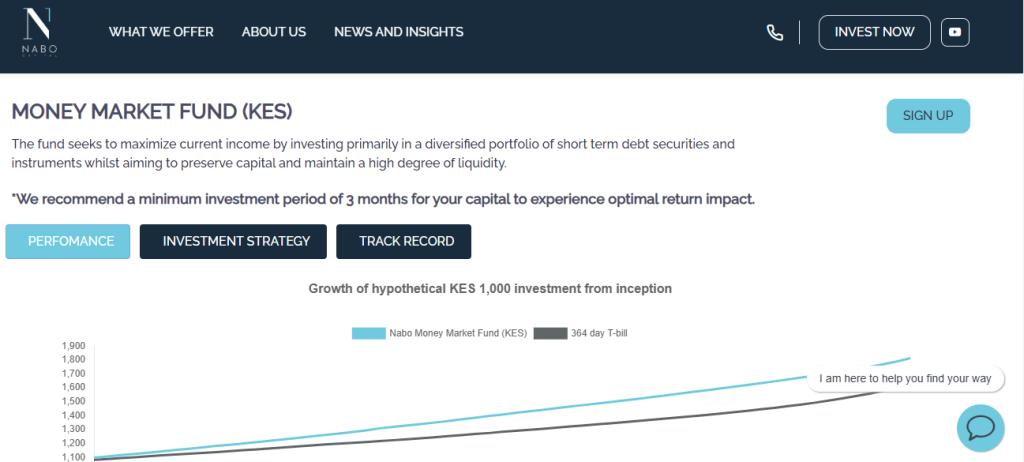

Nabo Africa Money Market Fund

The Nabo Africa Money Market Fund in Kenya came in eighth, earning a return of 14.67% in October 2024

The fund mainly invests in short-term obligation securities, such as government securities and corporate securities, with a recommended average holding period of three months and below.

Investors can withdraw funds within 24-48 hours of request and deposits begin with as little as Ksh. 100000 with subsequent top-ups of Ksh. 10000 upwards.

Nabo Capital manages the fund with KCB Bank as trustee, Stanbic Bank as custodian, and Grant Thornton as auditor.

Jubilee Money Market Fund

The Jubilee Money Market Fund came in ninth earning 14.60% of interest in October 2024 among the best performing MMFs in Kenya.

The fund invests in short-term money market securities that are readily marketable like Treasury Bills, Treasury Bonds, private commercial paper, public, commercial paper, corporate bonds and fixed and call deposits.

It offers high security to the investors by investing in both local and international securities markets that have been selected appropriately.

It requires an initial investment of KES 5,000 and subsequent top ups of KES 1,000, making it suitable for investors who want to invest in low-risk, high returns compared to banks.

The fund is tax-free on both income and capital gains, but any distribution is subject to a 15% withholding tax.

KCB Money Market Fund

KCB Money Market Fund gave a return of 14.41% in October 2024, coming in in the tenth position among the top 10 money market funds in Kenya.

This fund accumulates cash and invests in short-term low-risk instruments such as Treasury Bills, CDs, and high-rated commercial papers.

The minimum investment stands at KES 5,000, and the interest is compounded monthly and investors enjoy the freedom to readily access their funds at any time.

Steps to Choose among the Top 10 Money Market Funds in Kenya

Define Your Investment Goals

It is essential to establish what you stand to gain from investing in a money market fund, thus deciding whether you want to find a deposit box for temporary cash storage, or whether you want to look for ways to earn extra funds. Knowing this will assist in deciding what fund will be ideal for your investment time frame and your tolerance to risk.

Evaluate the Fund’s Performance

Check out previous performance records of the fund and compare them with some reference index, such as the 91-day treasury bill rates or, more so, other mutual funds available in the market. Although past performance cannot be taken as a gauge for the future, it can reveal much about how effectively a fund has handled its money.

Assess the Fees

Money market mutual funds demand charges or require you to pay through points of performance based on the total assets managed. Among the top 10 money market funds in Kenya locate those with low management and administrative costs since these detract returns in the long run.

Consider Liquidity and Withdrawal Terms

Make sure the fund is flexible regarding withdrawals because sometimes it can be crucial to have your money out of the fund.

Some investment funds may have restrictions that make it harder to redeem your cash early, or they may attract fees, so be sure to pick one that is going to suit your cash flow.

Review the Fund’s Risk Profile

Although money market funds are generally very secure, it is essential to look at the securities into which the fund invests. Domestic institutions’ funds are safer when they invest mainly in government securities as compared to their counterparts, such as corporate bonds or commercial paper investments.

Minimum Investment Requirements

Think about the initial capital to be invested in the fund and how much will be needed incase of top ups later. While some of these funds are relatively cheap, charging minimal fees to investors, others might only allow investors who are willing to invest a certain amount.

Check the Fund’s Liquidity and Access to Capital

Ensure that you identify with funds that can be accessed on a daily basis and do not lock your money down. This is especially useful if there is a probability that you need to draw on your funds; some funds might have limitations or times when you cannot redeem your money.

Understanding the Fund’s Management and Custody

Conduct due diligence on the fund management team and its performance. The aspect of efficiency can be attributed to a competent fund manager who has the responsibility of managing the investment, and, as a result, you must settle for a reputable fund manager who has made relatively sound decisions in the past. Also, verify the work of the fund and its custodian as well as the trustee to ask for accountability and transparency.

+ There are no comments

Add yours