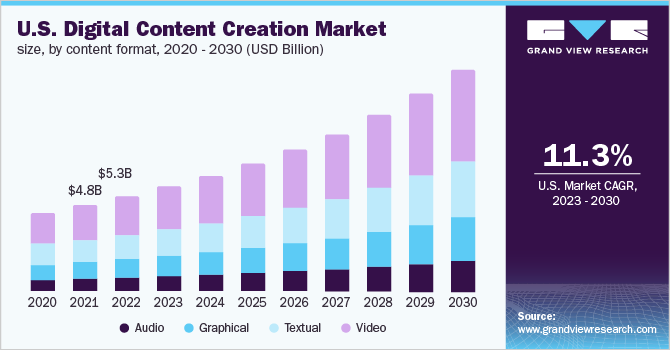

Brief Overview of the Global Content Creation Industry

Insurance coverage for content creators is essential for the creator economy, which is witnessing significant growth as it is a multi-billion-dollar industry today.

The industry is estimated to be worth about $104.2 billion and is forecast to reach double that number by 2027.

Today, there are 207 million content creators worldwide, and 200 million create content regularly.

More than 2 million expert content creators have established themselves in marketing and advertising to ensure direct interaction between brands and consumers.

Some brands enable the creator economy to thrive, sometimes generating billions in revenue. Shopify, for instance, made $5. 2 billion annually.

However, as the creator economy expands, so does the danger.

YouTubers and other content creators who seek to turn their platforms into businesses are exposed to certain risks, such as litigation, hacking, and data leakage.

The higher risk of financial and reputational losses leaves content creators vulnerable and requires them to obtain the correct insurance coverage for their business and income.

Why Insurance is Important to Content Creators

Content creators work in a world of opportunities and challenges that are ever-present and quite diverse.

As their outreach and followers increase, so does the liability for monetary and image-related issues they inherit.

Insurance Coverage for Content Creators protects content creators from possible threats that may harm their income.

General Vulnerabilities that Content Creators Encounter

There are several risks that content creators face, the most common include:

Financial Risks: The risk of losing sales because of hijacked or compromised social media accounts, hacks, or breach of contract.

Lawsuits Over Content and Partnerships: Many creators get into trouble over contractual disagreements, mainly when brands feel that content or texture was not delivered as promised.

Brand Defamation and Breach of Contract: Lawsuits, charges of defamation of a brand, or breaching the agreed-on terms of service can also prove expensive.

Social Media Hacking and Data Breaches: The hacking of content creators’ accounts has increased, with hacked accounts posing repercussions such as loss of income, followers and data leakage.

FTC Regulations on Sponsorships: The Federal Trade Commission (FTC) demands that sponsored content be labelled accurately. Non-compliance may lead to penalties, or even legal proceedings, and severe spillovers to the company’s reputation.

ALSO READ: List of the Best Insurance Companies in Kenya

Essential Insurance Coverage for Content Creators

Property and Content Insurance

For content creators, fixed assets such as cameras, laptops, and editing equipment are vital to their business operations.

It is relevant for businesses to have property and contents insurance to protect such valuable commodities.

This Insurance Coverage for Content Creators protects against losses in situations such as a break-in or fire at the creator’s home office, studio, or co-working space.

Property and content insurance cover can also include items such as stocks or merchandise, where creators sell branded products.

Since many creators store and use multiple technical devices, it is helpful to check that the insurance includes not only fixed but also portable and technical property.

It offers creators security because they can quickly return to work without worrying about financial disasters.

Loss of Income Insurance

Cybersecurity has continued to manifest as a significant concern for independent content creators.

Hacking is devastating as it limits victims’ access to funding, such as sponsorships, brand collaborations, and advertising revenues.

For instance, if a creator’s Instagram or YouTube account is hacked, they may be unable to post their content and, therefore, may not be paid for days or weeks.

Revenue Insurance Coverage for Content Creators protects income during these disturbances by covering all lost business earnings.

As hacking becomes more complex and frequent, it is good to consider ensuring such a type of income loss.

To creators, having this coverage is crucial because it enables them to continue operating the business when a cyber-attack occurs.

General Liability Insurance

General liability insurance provides essential coverage for content creators against numerous probable situations during content creation, such as accidents, injuries, or property damage.

For example, the cover would help in case a content creator hired a location for shooting and a crew member caused some damage to the property.

This also includes critical libel claims… especially since content creation is usually done in the public domain.

General liability Insurance Coverage for Content Creators also pays when a brand or another person sues for defamation owing to a statement in a video or post by the company.

This form of insurance may also cover travel insurance for creators who require moving around to do collaborations, shoots, and public relations events.

It protects against any incidents or emergencies the travelling professional may encounter on such trips.

Professional Liability (Errors and Omissions) Insurance.

For content creators, deadlines are not met, costs exceeding set budgets, or other allegations of the quality of content provided may lead to legal processes with the client.

Professional liability insurance is critical when a client can argue and say that a creator did not deliver as per the agreed standards.

A brand can take legal action against a creator if he or she fails to deliver content quality on the agreed date or the needed quality.

This insurance provides for attorney’s fees, and if the firm needs to pay the client as per the court’s ruling, this has to be catered for.

This Insurance Coverage for Content Creators also offers coverage for more severe claims such as plagiarism, invasion of privacy or breach of confidentiality.

A prime example is where the creators work with delicate brand information or other forms of intellectual property since the policy offers protection against financial and reputational loss.

Media Liability Insurance

Media liability insurance is intended particularly to protect content creators from legal claims concerning advertising standards, copyrights, and other complaints.

Creators can be sued for accidentally violating advertising laws, not disclosing partnerships as mandated by the FTC or using copyrighted materials.

This insurance is helpful to the influencers who collaborate with the brands as it offers coverage for negligent promotion and contract breaches.

The coverage caters for a creator’s manpower, like social media managers or video editors, from possible damages such as legal or property damages.

The cover caters for legal action against a social media manager who omits an ad disclosure in the post.

It covers a significant number of possible legal risks connected with utilizing media and provides authors with an opportunity to avoid legal issues regarding their work.

How to Choose the Right Insurance Provider

Examining Your Unique Risks and Insurance Requirements

Before selecting an insurance company, evaluating the potential dangers stemming from the content creation process is necessary.

Determine what kind of content you create, the technical gear you employ, and your partnerships.

For example, a vlogger focusing on travelling activities might be exposed to risks different from those of a digital artist operating behind a studio.

Some matters may include cybersecurity risks, legal responsibilities of responding to third-party claims, and loss of physical assets.

Customizing insurance coverage means ensuring essential risks are well-catered depending on different scenarios.

Traditional Business Insurance Vs. Creator-Specific Insurance Solutions

A conventional business insurance policy may not have all the coverage that could be useful for content creators.

For instance, choosing general liability insurance may leave a business unprotected against hacks of social media accounts or content-related legal actions.

Creator-specific insurance policies are intended to provide an adequate solution, especially for media liability, blunders in professional performance, and account loss and delays.

Geographic reach: Particularly for travel influencers

Geographic coverage is crucial if you often shoot, work with partners, and attend brand events in different locations.

Make sure that your insurance policy is sufficient in your home country and in addition to the other countries if you deal online.

Depending on the policy, it may be possible to receive medical services in any country, while others may not allow this.

It’s essential to check the coverage limits or any exclusions on travel since there may be some gaps in the protection.

Conclusion

In conclusion, insurance is an essential factor that business owners must undertake to protect their operations and finances when creating content.

Important insurance that includes property and content, loss of income, general and special liability, and professional and media insurance comprehensively covers various perils.

These policies not only serve as financial protection, but they also help to have a sense of relief and not bother with potential difficulties all the time.

Due to the unpredictable nature of the content creation process, it may be wise to consult a professional specializing in insurance.

Evaluate your particular requirements, evaluate different suppliers and insurance plans, and guarantee that protection complies with your enterprise operations and travel schedule.

With these measures in place, the creative venture will not be at the mercy of threats, and it will be possible to remain relevant and prosperous in the evolving creator economy.

+ There are no comments

Add yours