Money Market Funds in Kenya (MMFs) have been adopted as Kenya’s safest and best-performing investment ventures in the Kenyan market.

These funds collect money from investors and invest it in risk-free, short-term instruments such as Treasury bills and fixed deposits.

MMFs have high liquidity and capital safety and usually give higher returns than savings accounts.

What are Money Market funds?

MMFs are mutual funds that offer investors an easy method of investing their money by pooling funds in a common bucket in ventures with minimal risk of loss.

Such pooled resources are employed to purchase short-term and quality instruments like government securities, Treasury bills, commercial papers, and other certificates of deposits.

MMF’s fundamental objective is to protect principle capital and earn a slightly higher interest rate than regular savings accounts.

MMFs offer daily redemption, enabling the investor to get back the money he invested at any given time.

Savings accounts offer fixed interest rates, while money market funds in Kenya offer varying rates.

Still, they usually yield better interest rates than savings accounts; hence, they are invested in a portfolio of short-term assets.

This makes MMFs appealing and convenient for those who wish to invest their cash surplus without being exposed to a lot of risk to gain the highest possible cash yield.

Selecting the Best Money Market Funds

Selecting the right money market fund in Kenya means carefully considering key factors to match your goals and risk appetite.

Return on investment (ROI) is never constant and can differ from one fund to another. Therefore, it is recommended that one checks the past performance and the current rates.

A fund manager’s reputation: A fund manager with a proven track record of consistency in risk management is preferable.

Fees are another crucial aspect that can affect the net returns when investing; it is advisable to consider funds with minimal management charges.

A certain level of liquidity is also important, particularly if you anticipate a need to access the funds.

Ensure that the MMF does not lock in the investors and their funds and that withdrawals can be made at any one time without attracting a penalty.

It is also important to consider objectives and risk characteristics. Some funds may deliver slightly higher returns compared to other funds that may be more conservative, preserving capital.

Communication frequency and clarity: review the performance history and investigate the manager’s reporting frequency and style.

Reading reviews and rating services can also provide additional information regarding the fund’s reliability and relevance to investor requirements.

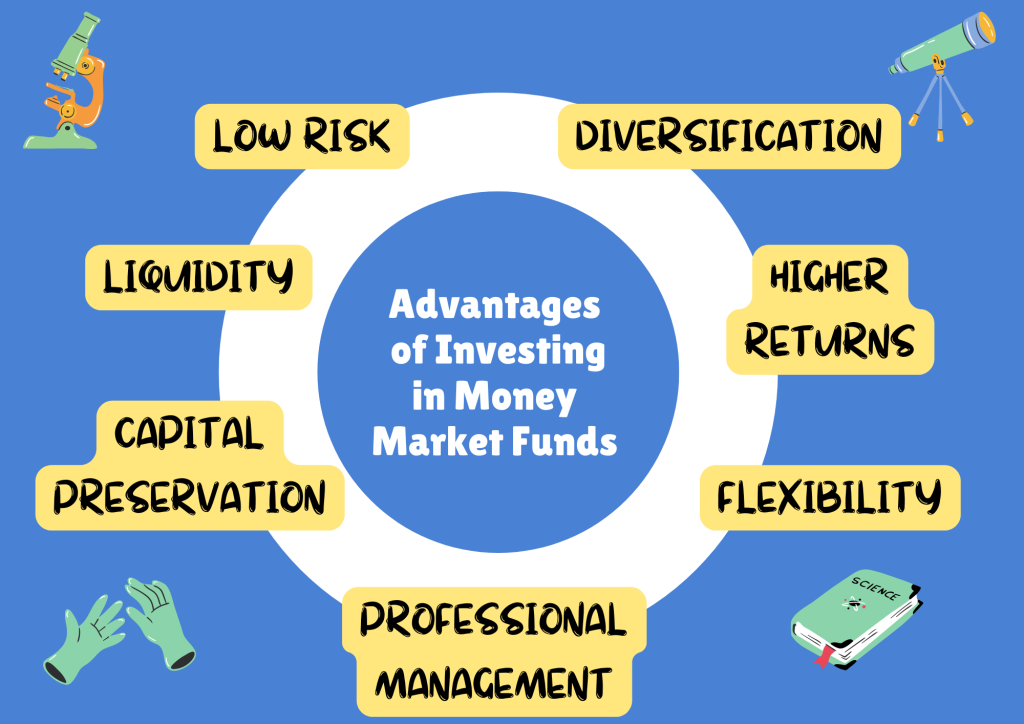

Advantages of Investing in Money Market Funds

Low Risk: MMFs can invest in high-quality short-term debt instruments to be exposed to losses very hard.

Liquidity: Investors can get their money anywhere, anytime, without complicated procedures and charges for withdrawing the money.

Higher Returns than Savings Accounts: MMFs generally provide higher yields than ordinary savings accounts, yet they are relatively risky.

Capital Preservation: Money market funds in Kenya include Conservative investment strategies. Since MMFs do not aim to generate high returns for investors, they are designed to maintain their initial capital worth.

Diversification: MMFs collect funds from the public and invest in different types of securities to distribute risk across securities.

Professional Management: Professionals work with financial resources about market conditions to realize long-term investment returns.

Flexibility: MMFs offer the flexibility of investing short-term as a holding place for investors’ money while maintaining the possibility of increasing value.

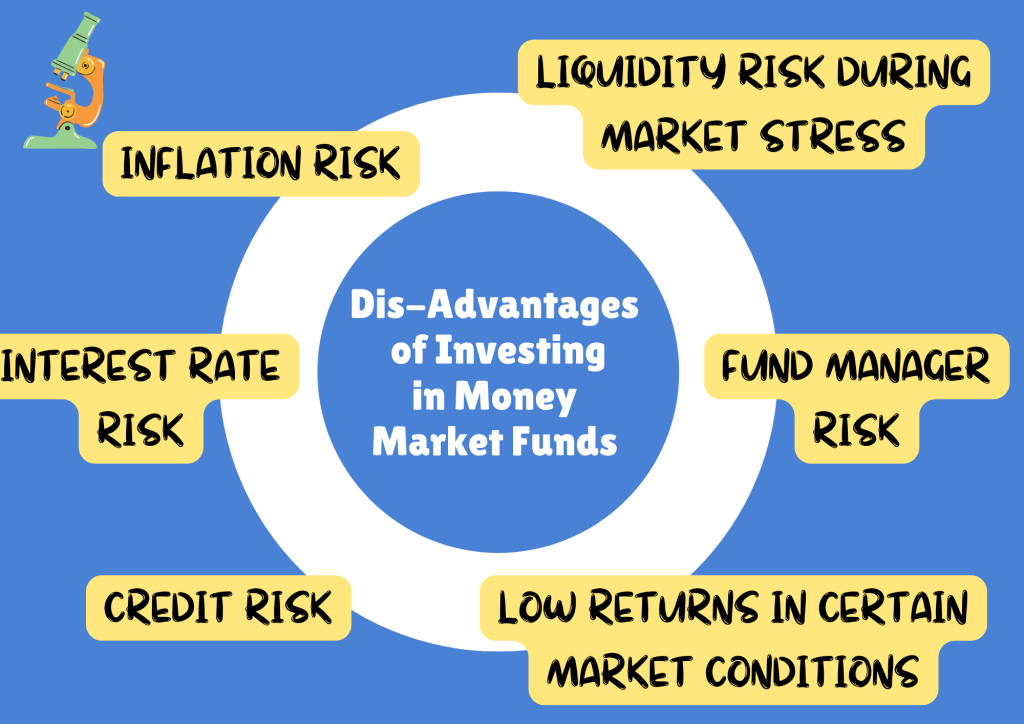

Risks of money market funds

Inflation Risk: Your money invested in MMFs may yield less than the inflation rate; hence, your money’s value will decrease with time.

Interest Rate Risk: Generally, changes in interest rates impact the returns of MMFs as the yields on short-term instruments may reduce under a rising rate regime.

Credit Risk: Despite this, MMFs invest only in high-quality securities, but if the issuer of such securities fails, the fund is affected.

Low Returns in Certain Market Conditions: During such conditions, the returns in MMFs could be as low as the spread above the base interest rate; thus, the beauty of MMFs may be shadowed.

Fund Manager Risk: It is self-explanatory that the fund manager’s capacity and actions greatly influence the performance of MMFs. Lack of proper management or poor policies regarding information disclosure may result in poor performance.

Liquidity Risk During Market Stress: When there is a financial or economic crisis or any market upset, the liquidity of the MMFs may be dampened, thus the ability to redeem their money may also be difficult.

How to Begin Investing in Money Market Funds

The steps for opening an MMF account in Kenya are straightforward and can be done through any fund manager or financial institution.

When investing in MMFs, you must consider going for a reputable fund manager or bank offering MMFs like Cytonn, Britam, or KCB.

When you select the appropriate fund to invest in, you will complete an account opening form online or in person.

Some essential documents include national ID/passport, KRA PIN for tax compliance, and passport-size photographs taken within the last year.

After completing the documents, you must deposit some amount into the fund, starting from Ksh1000 or more.

Most MMFs offer the advantages of mobile or online banking. This means you can invest your money and monitor your investment through the Internet.

When you deposit, your money is combined with other investors and placed in low-risk security instruments, which mature shortly.

It also enables you to make statements and performance tracking, and withdrawals can easily be made, enabling one to access the funds for use.

Some Top Money Market Funds in Kenya in 2024

Cytonn Money Market Fund

Nabo Africa Funds

Apollo Money Market Fund

Britam Money Market Fund

Madison Money Market Fund

KCB Money Market Fund

African Alliance Kenya Equity Fund

Co-op Trust Investment Services Limited

+ There are no comments

Add yours